Everything you ever wanted to know about Bitvavo

Who is this article for?

- you are interested in buying, selling, and storing digital currencies

- you are a new trader who is just getting started with cryptocurrency investing

- you are an experienced traders who is looking for a new platform to use

- you are living in Europe and looking for a locally-based exchange that supports popular payment methods

- you are looking for a platform with low trading fees and a user-friendly interface

- you are a professional/institutional trader looking for advanced trading features or high-volume trading

- you are NOT looking for a platform that supports a wide range of fiat currencies

What is Bitvavo?

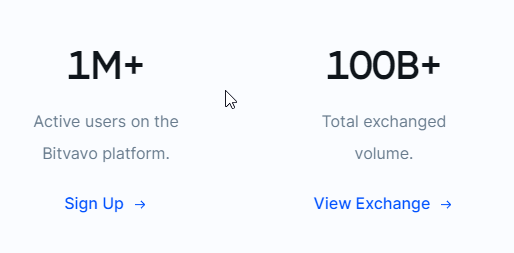

Founded in 2018, the Netherlands-based cryptocurrency exchange Bitvavo lets users buy, sell, and store cryptocurrencies. Numerous cryptos are available on the platform, including well-known and „younger“ altcoins. Along with various payment options, Bitvavo also accepts credit cards, and bank transfers. The platform’s intuitive user interface makes it easy for both seasoned and beginning traders to navigate.

Additionally, Bitvavo offers a free mobile trading app and round-the-clock customer service.

Offering their platform in multiple European languages (e.g. German), one of Bitvavo’s objectives is to provide a localized platform to European users that are not as comfortable with exchanges in the English language.

Bitvavo – registered in Amsterdam, Netherlands – as a payment institution is subject to Dutch regulation and under supervision by „De Nederlandsche Bank“ and complies with EU anti-money laundering laws.

What Are the Benefits of Using Bitvavo?

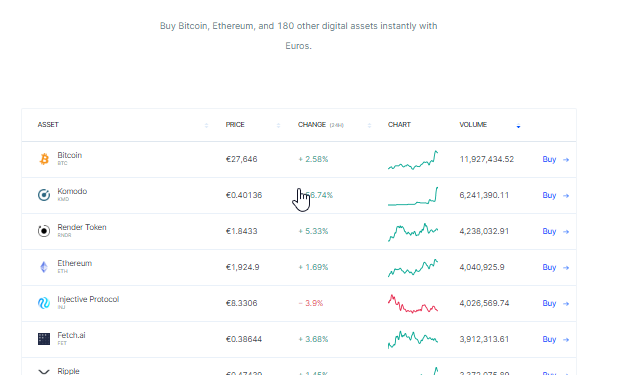

Bitvavo offers a broad choice of trading pairs, including both well-known cryptocurrencies and lesser-known altcoins.

Bitvavo is registered as a payment institution with the Dutch Central Bank and is compliant with the EU’s anti-money laundering regulations.

Bitvavo also implement various security measures to protect users‘ assets.

Bitvavo prides itself on offering low trading fees no deposit or withdrawal fees.

Off-chain and on-chain staking services – collectively referred to as staking services – are provided by Bitvavo. There is the option to earn rewards on both active and inactive account balances that you keep in your Bitvavo account by using the off-chain staking services. You have the option to actively participate in the transaction validation (comparable to mining) process on a proof-of-stake blockchain thanks to the on-chain staking services. Anyone with the minimum balance of a particular digital asset on these blockchains can validate transactions and receive staking rewards.

Bitvavo exchange has high trading volume and high liquidity, which results in quick order execution and tight spreads for users.

Bitvavo offers an API, making it possible to execute actions on or request information about the digital currencies that can be traded on our platform.

Bitvavo supports a wide range of payment methods, including bank transfers, credit cards, and popular e-wallets like iDEAL and Bancontact. This makes it easy for users to deposit and withdraw funds.

Bitvavo also provides a mobile app for trading on-the-go.

The platform offers a user-friendly interface, making it easy for both experienced and new traders to navigate.

Services to track your coins and trading activities, mostly for the purpose of tax reporting, are supporting Bitvavo.

Here is one popular example: Cointracking ![]()

Bitvavo has a dedicated customer support team that is available 24/7 to assist users with any questions or issues they may have.

Which Cryptocurrencies Are Available On Bitvavo?

On Bitvavo currently, you will find around 180 cryptocurrencies available for trading.

Since adding additional cryptos to the list of tradable assets on Bitvavo is one of the most popular requests of Bitvavo customers, the team continuously checks for new and exciting assets that potentially are good additions to the platform.

The choice goes from well-known top 20 projects to more upcoming, young, and ambitious projects – here is just a tiny random excerpt from their extensive list: BTC, ETH, BNB, ADA, XRP, MATIC, QNT, GALA, VET, FET, LINK, AVAX, ALGO, NEAR, CAKE, MKR, EGLD, SUSHI

In the section „assets“ on the Bitvavo website you can find all detailed information on assets currently available on the platform. New listings are announced on the official Bitvavo blog.

Order Types on Bitvavo

Bitvavo offers a variety of order types to allow users to trade in the way that best suits their needs.

Let’s have a look at the order types available on the platform:

- MARKET ORDER - a market order is executed at the current market price, and is the most common type of order. Market orders are executed immediately and are used when the user wants to buy or sell a cryptocurrency quickly.

- LIMIT ORDER- a limit order is executed at a specific price, and allows the user to set a maximum or minimum price at which they are willing to buy or sell a cryptocurrency. This order type is used when the user wants to buy or sell a cryptocurrency at a specific price or better.

- STOP-LOSS ORDER - a stop-loss order is used to limit the user's losses in case the market moves against their position. This order type is executed when the price of the cryptocurrency reaches a certain level, and it is used to sell a cryptocurrency at a lower price than the current market price.

Security Measures by Bitvavo

Bitvavo attaches great importance to the security of user funds and has implemented a number of security measures to protect user assets Some of the security measures in place include:

2FA

Bitvavo asks users to enable two-factor authentication, which adds an extra layer of security to the login process . This means that, to access the account, users must enter a one-time code generated by an authenticator app in addition to their username and password.

SSL

Bitvavo uses SSL encryption to protect data sent between user devices and the exchange This encryption protects sensitive information, such as login credentials and personal information, from hackers

Compliance

Bitvavo complies with Dutch and EU regulations, which help protect user assets and prevent fraud

Audits

Bitvavo performs regular security audits to identify and fix vulnerabilities in its systems This keeps the platform secure and protects user assets.

Support

Bitvavo offers support for users who have questions about security or need help protecting their accounts. They also have a detailed FAQ section and tutorials on their website

Cold Storage

A significant portion of Bitvavo's digital assets are stored in cold storage, which is not connected to the internet This ensures that the assets are protected against hacking and other online threats

Deposit Guarantee

Bitvavo offers support for users who have questions about security or need help protecting their accounts. They also have a detailed FAQ section and tutorials on their website

Cold Storage

A significant portion of Bitvavo's digital assets are stored in cold storage, which is not connected to the internet This ensures that the assets are protected against hacking and other online threats

It is important to note that despite these security measures, users should take their own precautions to protect their accounts, such as using strong and unique passwords, securing recovery keys, and using a separate email address for their account By following best practices and using existing security measures, users can ensure that their assets are protected on the Bitvavo platform..

Conclusion

INetherlands-based cryptocurrency exchange Bitvavo allows users to buy, sell, and store virtual currencies, including bitcoin, ether, and litecoin.

There are many trading pairs on the platform, including these well-known and lesser-known altcoins apart from the multiple payment options, Bitvavo also accepts credit cards, bank transfers, and other e-wallets like iDEAL and Bancontact

The platform has an intuitive user interface, which makes it easy for both experienced traders and beginners to navigate Additionally, Bitvavo offers a mobile trading app and 24/7 customer support.

Bitvavo complies with EU anti-money laundering laws and is under supervision and regulation of the Dutch central bank and Dutch authorities.