Vesting - what does it mean?

Imagine you’re investing in a new cryptocurrency project, and the creators give you a bunch of tokens as part of the deal. Now, vesting is like a smart rule that says, „Hey, you can’t just grab all these tokens and run. You need to stick around and wait a bit before they’re fully yours.“

It’s a bit like a game where you earn points over time. Instead of getting all your points at once, you get a certain amount each month or so. That’s vesting in action.

Now, why does it matter? Well, think about it this way: the creators of the project want to make sure that the people who got the tokens are committed for the long haul. If everyone could just sell their tokens immediately, it might create chaos. The project needs a stable team and supporters.

So, when you’re checking out a new project to invest in, take a peek at how the tokens are vested. If everyone can sell everything right away, it might mean people could bail out fast, which could be risky for the project. But if there’s a gradual schedule for when people can cash in their tokens, it’s like a sign that the team and investors are in it for the long run. That’s generally a good thing for the project’s stability.

In simpler terms, vesting is like a promise to stick around and help the project grow before you can cash in all your tokens. It’s a way to make sure everyone is committed and working together for success.

What's the impact of vesting on the investment decision?

Token unlocks, also known as token releases or vesting events, can have a significant impact on the price of a cryptocurrency token. Understanding these dynamics is crucial for investors and participants in the crypto market. Here are some key points to consider:

- Immediate Price Pressure:

When a significant number of tokens become available for sale due to a vesting event or unlock, it can create immediate selling pressure on the market. If a large portion of the token supply is suddenly released, and there isn’t enough demand to absorb the supply, the price may experience a decline. - Market Perception:

Token unlocks can influence market perception. If the community and investors interpret a large unlock as a lack of confidence from team members or early investors, it may lead to negative sentiment and a subsequent decrease in the token’s price. - Volatility Spike:

Token unlocks often result in increased volatility. Traders and investors may react to the news by adjusting their positions, leading to sudden price movements. This heightened volatility can present both opportunities and risks for market participants. - Gradual Unlocks vs. All-at-Once:

the manner in which tokens are unlocked matters. Gradual releases over time, as opposed to a large lump sum, can help mitigate immediate price shocks. Projects that implement a phased vesting schedule provide a smoother transition for the market. - Impact on Liquidity:

Token unlocks can impact liquidity, especially if a substantial portion of the unlocked tokens is traded on the market. Insufficient liquidity can exacerbate price fluctuations, making it more challenging for participants to execute trades at desired prices. - Investor Sentiment:

The sentiment of the project’s community and the broader market plays a crucial role. Positive sentiment around the project’s development, partnerships, and achievements may help offset potential negative effects of token unlocks on the token’s price. - Strategic Unlocking:

Some projects strategically plan token unlocks around positive developments or milestones. For example, unlocking tokens after the achievement of a major project milestone may create a positive narrative, potentially mitigating negative market reactions. - Long-Term Impact:

While short-term price fluctuations are common around token unlocks, the long-term impact depends on various factors, including the project’s fundamentals, adoption, and ongoing development. Projects with a strong foundation and clear utility for their tokens may recover from short-term price volatility. - Market Conditions:

External market conditions also play a role. During periods of overall market bullishness, the impact of token unlocks may be less pronounced. Conversely, in bearish market conditions, even a moderate unlock could lead to more substantial price declines.

In conclusion, the impact of token unlocks on the price of a cryptocurrency token is multifaceted and depends on factors such as the size of the unlock, the market’s perception, the project’s fundamentals, and the overall market conditions. Investors should carefully assess these factors and consider the potential implications of token unlocks when making investment decisions.

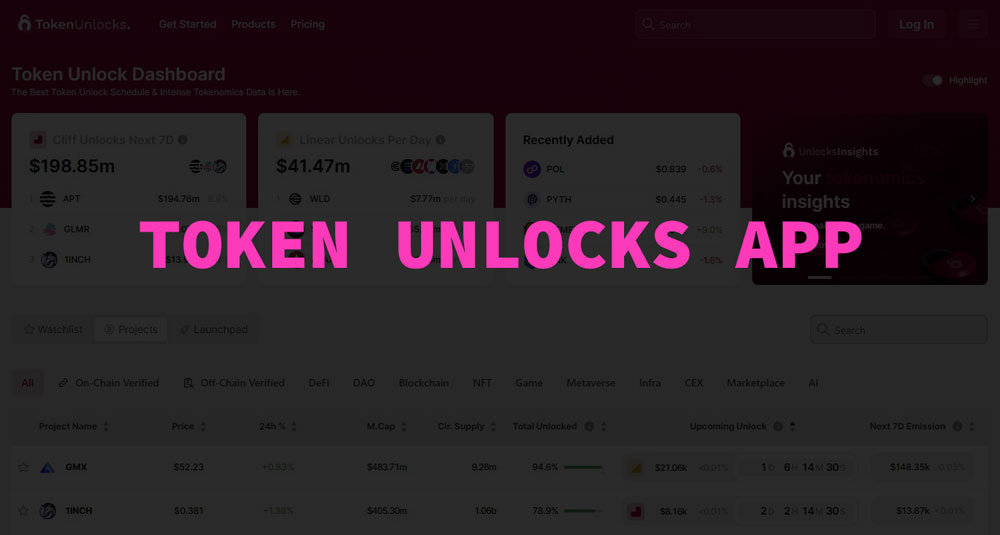

A free tool to help you out....

You can check out the free version of Token Unlocks any time and investigate about the current status of the project you are researching about.

Daosurv.com states about their product:

„the best token analytics dashboard that monitors vested tokens, notifies users of upcoming unlock events and provides comprehensive tokenomics information. We curate both on and off chain data to deliver to you with the best intuitive user experience.„